Deep Dive: ALUM Clubs

Branded residences for affluent & tribal college communities

Don’t miss Thesis Driven’s Buy Box deep dive on ALUM Clubs next Thursday, August 28. Register here (for accredited & institutional investors only)

There are 400,000 living alumni of the University of Alabama. And on any given football weekend in Tuscaloosa, you’d think they all came home at once.

They book hotel rooms a year in advance. They rent Airbnbs with broken coffee makers. They tailgate in blazers and branded Yetis. And they spend big on memories, connection, and tradition. But what they don’t have is a place that feels like their own.

That’s the white space ALUM is attacking. A new hospitality and real estate platform targeting college towns where the alumni, parents, and fans are both affluent & tribal—starting in Tuscaloosa, with an $88 million branded club and 68-unit condo project.

The model is simple: luxury condo-hotels + a private club + all-day F&B + university-specific programming. But the thesis goes deeper. Wealthy alumni & fans now return often and want more than lodging—they want access, identity, and ownership. And they’re increasingly joined by out-of-state parents, especially from the Northeast and California, who treat Alabama weekends like social events and are buying homes they use only a few times a year.

Many are already investing big dollars in NIL campaigns and booster clubs. Now ALUM is offering a turnkey real estate investment opportunity to this cohort with a clear ROI: “use it when you’re in town, cash flow it when you’re not.”

Beyond Tuscaloosa, ALUM has designed a ten-year roadmap to build a portfolio of luxury, legacy-driven real estate assets across 25+ college markets. It’s a bet on place-based identity: that a well-designed clubhouse with residences can turn fan passion into recurring revenue, brand loyalty, and multi-generational engagement.

In this Thesis Driven letter, we’ll break down:

Why College Towns, Why Now – Alumni wealth, travel, and NIL shifts

Branded residences and the ALUM Model – Branded real estate with identity yield

Inside Tuscaloosa: The Flagship Project

The Team & Execution Strategy

Scaling the Playbook – 25+ markets of tribal demand

Why College Towns, Why Now

College towns have always punched above their weight, but today they’re punching with capital and consistency.

The University of Alabama exemplifies this shift. As of Fall 2023, 58% of its undergraduate students come from out of state, a major increase from historical averages. These students tend to come from affluent regions (think Northeast prep schools and California suburbs) bringing not just tuition dollars, but social capital, discretionary income, and repeat travel behavior.

Add to that the post‑NIL reality. Since the NCAA opened big-money doors in 2021, alumni giving has surged with expectations attached. Buyers want more than a name on a donor wall. They want lifestyle, access, and yes—yield. ALUM’s proposition taps directly into that dynamic: a turnkey condo‑hotel with a private club, generating income when owners aren’t in town, which is a tangible payoff, not a plaque.

Combine the tribal behaviors of SEC, Big Ten and Big 12 fans with the rising wealth (out-of-state students and their families) and post-NIL expectations, and suddenly, college towns look like investment opportunities, not just sentimental getaways.

In that context, Tuscaloosa isn’t just a pilot market. It’s a blueprint: a place where identity, investment, and infrastructure intersect—and where a well-designed branded residences program plus clubhouse can transform fandom into a durable, high-return asset.

Branded residences and the ALUM Model

The concept of branded residences isn’t new. Luxury operators like Aman, Ritz-Carlton, and Four Seasons have been selling them for years: fully serviced condos attached to five-star hotels, marketed to wealthy buyers who want ownership with the convenience of professional management and the cachet of a global brand.

Owners use their unit when they want; and when they don’t, the property is rented out as part of the hotel inventory. It’s a proven business model that has delivered strong absorption rates and premium pricing in markets from Miami to Bangkok.

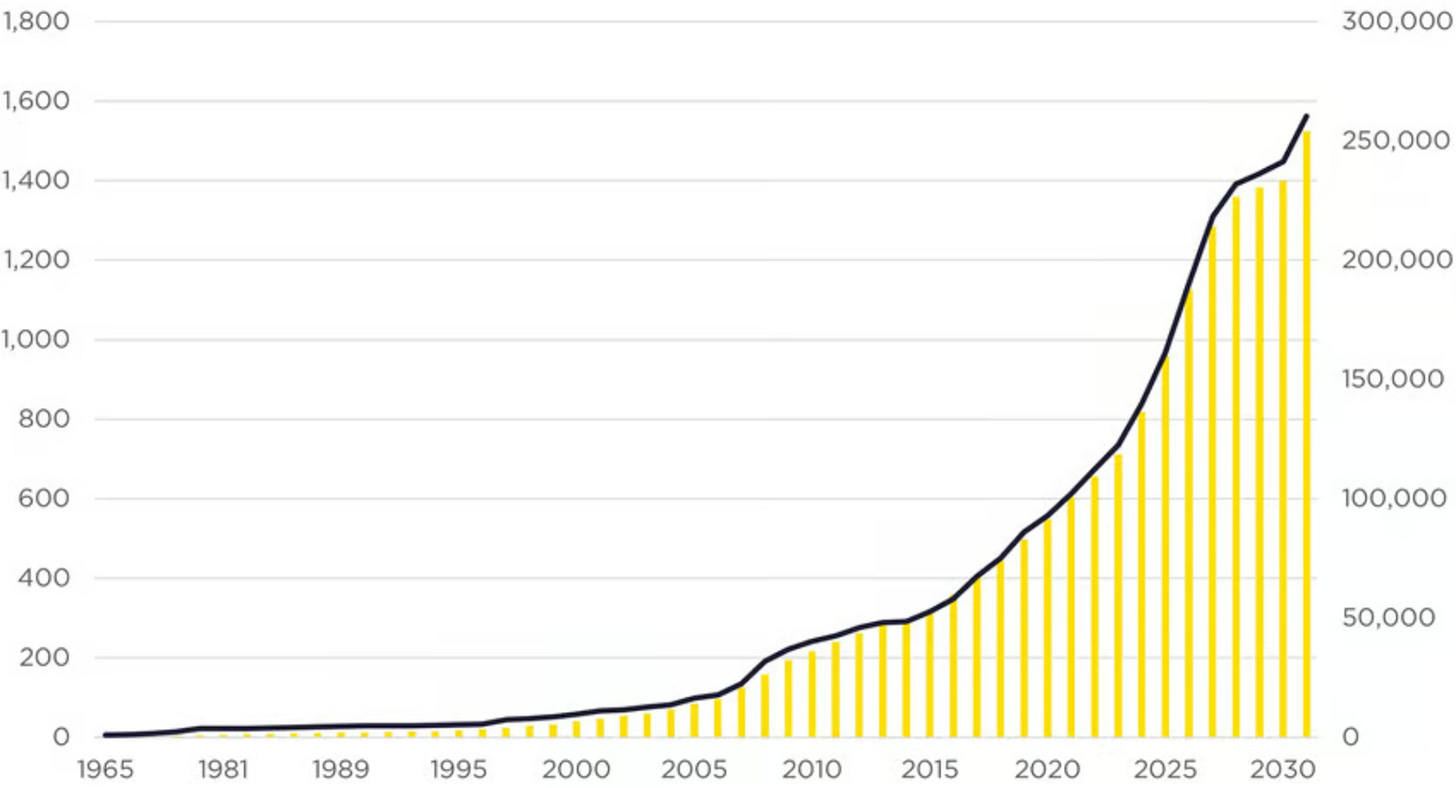

Growth in branded residence assets (left Y axis) and units (right Y axis) Source: Savills

ALUM is adapting that structure for a different but equally passionate customer base: college town alumni, parents, and fans. Instead of global brand equity, ALUM leans into university affinity. Instead of beachfront or ski-in/ski-out, it’s proximity to the stadium and downtown. And instead of traditional hotel amenities, the product is layered with a clubhouse experience: an all-day restaurant and bar, gameday events, exclusive merch, and member programming that reinforces community.

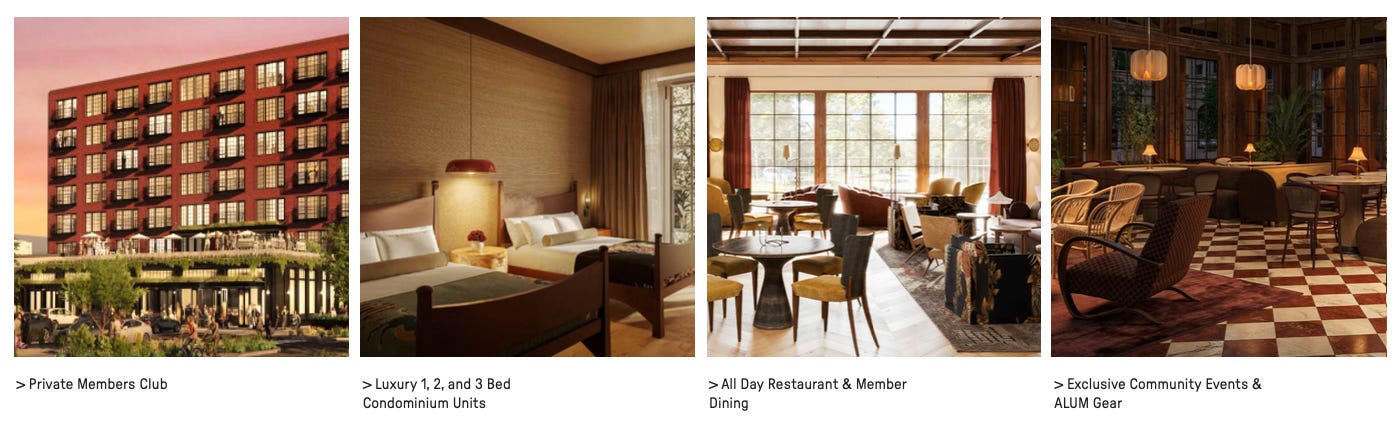

Alum’s Tuscaloosa project–an $88 million development–will feature 68 condo-hotel units ranging from one to three bedrooms, combined with a private members’ club, restaurant, outdoor pool, and event spaces a few blocks from Bryant-Denny Stadium. The design is intended to serve two overlapping needs: (1) a turnkey second-home base for game weekends, and (2) a managed hospitality product that generates income when owners are away.

To see how the value proposition works, consider a notional two-bedroom unit priced at $900,000.

An owner might put in 30% equity ($270,000) and finance the rest with a mortgage.

On gameday and peak weekends, that unit can rent for $1,200–$1,500 per night; on non-peak weekends, perhaps $500–$700.

Conservatively, if the unit averages 120 rental nights per year at $800 per night, that’s $96,000 in annual gross revenue.

After management fees, HOA dues, and operating expenses (estimated at 35–40% of revenue), net operating income might come to $55,000–$60,000 annually.

That more than covers annual debt service on a $630,000 loan (~$45,000 at today’s rates), leaving positive free cash flow in addition to appreciation potential.

For the buyer, the math is compelling. They get a second home that pays for itself, with professional management removing the hassle of short-term rental operations.

For ALUM, the model creates a steady pipeline of condo sales at premium prices (shortening the payback period to investors), operating income from the club and F&B, and recurring brand engagement through its member base. As more ALUM locations come online, the network creates cross-market loyalty and a differentiated brand that extends beyond the single project.

Tuscaloosa: The Flagship Project

The first project is a few walkable blocks from Bryant-Denny Stadium and designed to be the social hub for Alabama alumni life.

Project Snapshot

Residences: 68 condo-hotel units (one-, two-, and three-bedroom layouts)

Clubhouse: Private members’ club with exclusive access for owners and members

Dining: All-day restaurant and bar, open to the public with reserved areas for members

Amenities: Outdoor pool, lounge, and event spaces programmed for gamedays and year-round use

Location: Walkable to both Bryant-Denny Stadium and downtown Tuscaloosa

The layout mirrors what you’d expect from a high-end hospitality experience: professionally managed units paired with a clubhouse that acts as the social core. The restaurant and bar provide a daily presence in the city, while the private club and pool deck create a resort-like layer not typically seen in a college town.

While Alabama football now brings 100,000+ visitors per home game weekend, Tuscaloosa’s real estate market has also been growing, as home prices rose 14.4% year-over-year as of December 2024.

Alum’s early buyer profile is a mix of wealthy alumni / multi-generational families and out-of-state parents who make Tuscaloosa a recurring stop on their social calendars.

For alumni, the psychology is around belonging and exclusivity. For parents, it’s convenience and signaling: a turnkey place to stay that also cements their role in the campus community. And for both groups, it’s the chance to make an investment that is both personal and financial.

Additionally, the Tuscaloosa project acts as an archetype for a larger platform strategy. If ALUM can prove that this model works here, in the heart of SEC football, it can replicate the playbook in other passionate, tribal markets like Norman, OK (University of Oklahoma), Lexington, KY (University of Kentucky) and Eugene, OR (University of Oregon), where they are already pursuing the next phase of projects.

The Team & Execution Strategy

To execute on this multi-faceted hospitality strategy ALUM, built a core team that plugs into a network of specialist partners.

The ALUM Team

Co-Founders of ALUM are Paul Brenneke, a veteran developer and investor through Sortis Capital, and David Vialli, who has spent most of his career in hospitality, most recently scaling EDITION and Standard Hotels. Together, they run strategy and day-to-day execution: sourcing markets, structuring projects, raising capital, and refining the branded residence model.

They have separately assembled a set of partners to keep the brand, financial structure, and growth roadmap consistent, including:

Legends, an events company well-known for monetizing fan engagement in both professional and college sports. They’ve worked on projects like The Star in Frisco (Dallas Cowboys HQ and mixed-use district) and the Yankee Stadium Legends Suite Club, creating hospitality concepts focused on fan affinity + building new revenue streams. For ALUM, they’ll connect the platform directly to alumni associations and athletic departments, plus the programming and experience layer around the club.

Kasa, a hospitality operator specializing in tech-enabled, flexible-stay accommodations. They manage short-term rental portfolios across the U.S and will oversee all condo-hotel operations, providing professionalized management and optimized rental performance for owners. (Kasa founder Roman Pedan was a guest on Thesis Driven’s podcast earlier this year.)

Harrison, an architecture and design firm with a global hospitality and F&B portfolio. They’ve designed spaces for international hotel brands and lifestyle-driven clubs. For ALUM, they will design the residences and clubhouses with the goal of reflecting the character of each college town market (while staying high end).

The Gray Group, a Tuscaloosa-based real estate firm with deep knowledge of the local market, doing land acquisition, brokerage, and advisory for residential and mixed-use projects across Alabama. So they will provide site-level expertise, local relationships, and access to the local buyer network.

ALUM has also brought on early advisors and investors like Greg McElroy, a former Alabama quarterback turned ESPN analyst and media personality.

Scaling the Playbook

ALUM was conceived from the outset as a platform, not a one-off project, with a roadmap targeting 25+ college towns over the next decade. The opportunity set is defined by a repeatable formula that identifies markets where alumni loyalty intersects with wealth, culture, and unmet hospitality demand.

Criteria for New Markets

Fanbase Size. Large, passionate alumni and fan populations that return to campus multiple times per year (think football & basketball games, plus weddings, funerals and reunions); with large campuses / class sizes

Wealth. Affluent alumni and out-of-state parents with the means to invest in real estate and discretionary lifestyle spending (look where NIL budgets are highest)

Tribalism. A culture where school identity extends well beyond graduation, creating multi-generational ties and loyalty (and lots of bumper stickers & flags)

Hospitality Gap. Limited supply of premium, consistent lodging or second-home options near stadiums and campus

Using this framework, the next wave of ALUM projects is already in motion.

Norman, OK (University of Oklahoma): With OU’s move to the SEC in 2024, fan intensity and donor dollars are set to rise even higher. Norman’s hospitality infrastructure has not kept pace, making it a textbook candidate for ALUM’s model. OU’s alumni base is both regional and national, with strong booster culture and NIL momentum driving new spending patterns.

Lexington, KY (University of Kentucky): Kentucky basketball has long been one of the most tribal sports cultures in the country, and its fans travel from across the state and beyond. Yet Lexington has a limited supply of high-end lodging near Rupp Arena and campus. The alumni and donor base skews affluent, especially in healthcare, bourbon, and equine industries—groups predisposed to invest in branded real estate tied to their school identity.

Eugene, OR (University of Oregon): Oregon represents a different flavor of demand—less SEC tribalism, more lifestyle-driven brand affinity. Thanks to Nike’s Phil Knight and the deep pockets of West Coast alumni, Oregon athletics has one of the strongest donor ecosystems in the country. Eugene also benefits from proximity to Portland and the broader Pacific Northwest, giving it a steady flow of visitors who see Ducks games as social and cultural events.

The expansion logic isn’t just about capturing demand town by town–it’s also about building a network effect. As more ALUM locations open, owners and members don’t just buy into a single property; they can join a portfolio of “clubhouses” across the college sports landscape.

With a loyal base of consumers, ALUM may also have the ability to layer in retail (exclusive alumni gear), partnerships (with NIL collectives, brands, and media), loyalty programs (cross-market membership benefits), and content.

In that sense, Tuscaloosa could prove to be a prototype of a new asset class: branded real estate organized around identity, community, and fandom. The next decade will test how far that model can travel.

We’re excited to dig deeper with the founding team on Thursday, August 28th at 3pm EDT to discuss the project, business model, growth strategy, and opportunities to invest in both their brand and the Tuscaloosa development.

Register here (for accredited & institutional investors only).

–Paul Stanton